Latest Insights

Access concise articles featuring EDHEC’s new findings and insights in the field of climate finance.

Investors are seeking more transparency on risk assessment and actions taken to improve the sustainability of infrastructure

In this interview, originally published in the institute's newsletter (July), Rob Arnold, Sustainability Research Director at EDHEC-Risk Climate Impact Institute, delves into the development of a new body of knowledge on decarbonization and climate resilience strategies in the infrastructure sectors. He explains the necessity and beneficiaries of this knowledge, the project's structure, and how it addresses climate risks..

Finance of transition, transition of finance

In this article, originally published as an editorial in the July newsletter of the EDHEC-Risk Climate Impact Institute, Frédéric Ducoulombier, Director of the Institute, emphasizes the urgent need for increased investment in climate change mitigation and adaptation. He highlights the financial industry's potential role as a key facilitator and accelerator of the climate transition and identifies the necessary updates to drive this transformation within the finance sector.

The problems with climate scenarios, and how to fix them

In this article, initially published in The Conversation Europe, Riccardo Rebonato, EDHEC Professor and EDHEC-Risk Climate Impact Institute Scientific Director, calls for a revision of the current approach to emission projection models, proposing ideas and actions that move in the direction of probabilism.

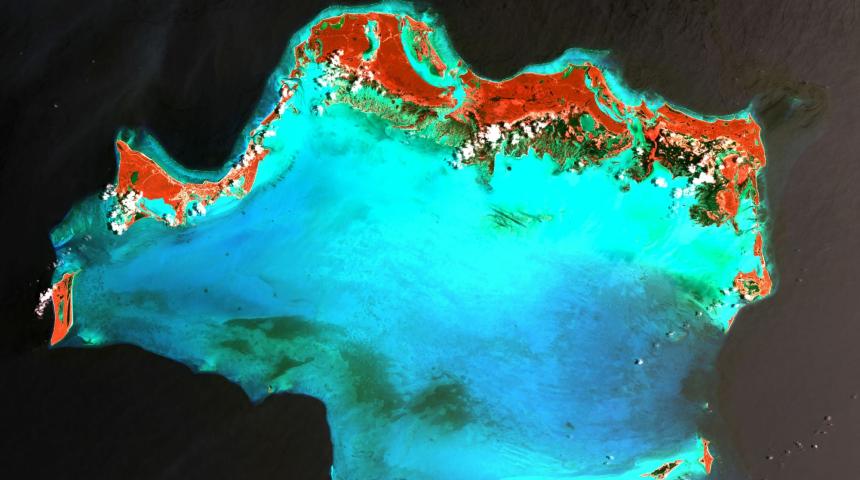

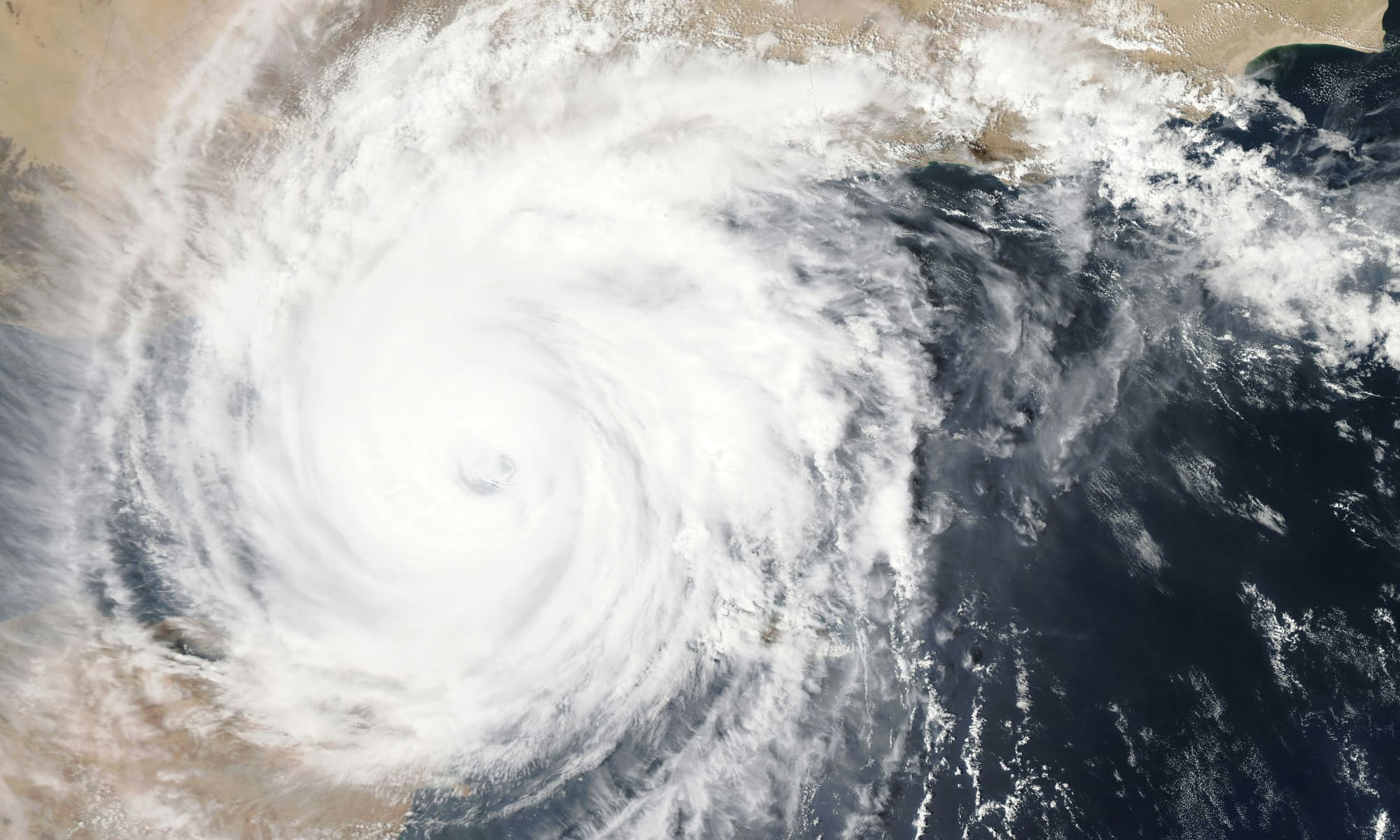

[#dataviz] Climate change could be very costly for those who have invested in infrastructure

Discover, through a dedicated carousel, the key points of the "Highway to Hell" study, published by the EDHEC Infra & Private Assets Research Institute in January 2024.The risks of transition and physical risks will affect all installations, with varying degrees of intensity: energy and water, data centres, transport, etc. The total bill could run into hundreds of billions of euros, but could be limited if an "orderly" transition is implemented. Here are a few illustrations to illustrate the main findings of this research.

Climate change: Why are infrastructure investors aware of the risk while failing to measure it?

In a new report, the EDHEC Infrastructure & Private Assets Research Institute states that an overwhelming majority of investors consider that climate risk will have a highly significant impact on their infrastructure investment but say that they do not know how to measure this risk and therefore manage it.

How companies calculate their carbon footprints

In this article, originally published in The Conversation Europe, Gianfranco Gianfrate, Professor at EDHEC and Research Director of the EDHEC-Risk Climate Impact Institute, looks at the application of internal carbon pricing, the modelling of the pricing method and its precise use in the private sector.

“Dark green” equity funds could go “full green” with very limited impact on their risk profile

Sustainable investment funds have blown up in size in the last decade. However, many funds that claim to be sustainable still contain stocks of companies involved in greenhouse gas-intensive industries. In this article, Scientific Portfolio (an EDHEC Venture) researchers present their newest study in which they analyse the impact of the exclusion of these controversial stocks on the performance and risk profile of these funds.

Why EDHEC Business School is a major player in Sustainable Finance

Facing colossal investment needs to address climate change and ensure sustainable and inclusive development of the planet, governments have voiced high expectations for the financial sector. At the same time, an increasing share of the population expects investment decisions to integrate environmental and social dimensions. Progress has been made, yet there is still a long way to go to building sustainable finance. EDHEC Business School is committed to actively contributing to this transformation, through research and training programmes as well as through direct involvement in the finance industry.

Frédéric Blanc-Brude (EDHECinfra): “Extreme Climate risks for investors in infrastructure are enormous and largely remain unrecognise, but today they can be measured thanks to EDHEC research”

The EDHEC Infrastructure & Private Assets Research Institute has just published a study entitled "Highway to Hell" (Dec. 2023) (1) which highlights that infrastructure investors could lose up to 600 billion dollars by 2050 due to transition risks and as large as 50% of certain portfolios due to physical risk. We’ve asked a few questions to Frédéric Blanc-Brude, Director of the Institute and co-author of the study with five other researchers.

Noël Amenc: « We provide finance decision-makers not only with research results but also with accurate tools and concrete solutions »

EDHEC Business School has been recognized for over 20 years as a finance expert. It stands out for its ability to provide finance and industry players with scientific tools and advice to help them integrate crucial climate change and sustainability issues into their decisions. Through several examples of research work, Noël Amenc – EDHEC Associate Professor and Climate Policy Coordinator EDHEC-Risk Climate Impact Institute, Scientific Infra & Scientific Portfolio – explains how our school has an impact on the real economy.

Winter of despair, spring of hope

This article, by Frédéric Ducoulombier, Director of EDHEC-Risk Climate, has been originally published in the inaugural newsletter of the institute. Models needed to measure and manage the financial risks from climate change are still in their infancy and much needs to be done to extend and repurpose these tools to make them relevant for asset pricing. This is the journey EDHEC-Risk Climate has set upon...

Frédéric Ducoulombier (EDHEC-Risk Climate) : « The double-materiality serves both investors and civil society »

In a Le Monde, op-ed, Emmanuel Faber (ISSB) represents that the double-materiality approach to sustainability reporting is a simplistic concept whose popularity derives from a “triple illusion.” [...] Frédéric Ducoulombier, Director of the EDHEC-Risk Climate Impact Institute, reviews the key elements of this debate.