Euro funds: a paradigm shift for French savers

Daniel Haguet, Associate Professor of Finance , EDHEC Business School, discusses in an article originally published on The Conversation the euro assets that are being slowed down by insurance companies.

At the end of September, insurance company Generali Vie announced its decision to significantly slow down inflows into guaranteed euro-denominated funds, and to clearly favor customer subscriptions to unit-linked products, i.e. Sicavs and mutual funds (FCPs). This decision was immediately followed by other insurers in Paris, such as Allianz, who also announced their unambiguous intention to increase unit-linked sales, to the detriment of the euro-denominated assets that savers value for their capital protection.

It should be remembered that euro-denominated assets are guaranteed by the insurance companies on which the risk rests, while unit-linked products place the risk on the end customer. Unit-linked products can be diversified, and some life insurance contracts offer several hundred products.

Low rates and attractive performance

This decision is based on two phenomena.

On the one hand, we are in a situation of extremely low, or even negative, interest rates, which means that the profitability of guaranteed assets, mainly bonds, is increasingly low. For some companies, the good profitability achieved in recent years stems from the distribution of reserves accumulated during more buoyant periods.

The tricky thing is that, the higher the inflows into euro funds, the more they will be invested in new low-rate securities, leading to a decline in overall profitability and the difficulty of maintaining attractive rates for customers. Many insurers are now subconsciously hoping for a wave of redemptions on euro-denominated assets, which have become a costly millstone around the neck for the Paris financial center.

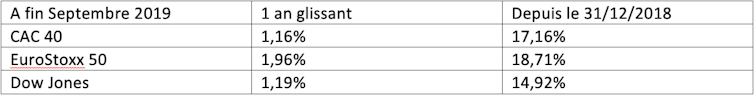

On the other hand, it has to be said that long-term financial markets, and equity markets in general, have been on a positive trend since the start of the year, and this has led to attractive returns.

On the other hand, these same financial markets, even if they generally follow a positive long-term trend, can, just like the economy which is growing or shrinking, suffer accidents along the way, sometimes painful ones.

We are therefore going to see a major paradigm shift for French savers. Gone are the safe-haven vehicles, and in are the more profitable but also more volatile ones.

Education to be reviewed

In this context, two precautions need to be taken.

Firstly, it is essential to take into account the psychological aspects of investing. Individuals generally display a strong aversion to loss, which can lead to sub-optimal buying and selling behavior. By way of illustration, the disposition effect, which leads individuals to sell winning assets and hold on to losing ones, can lead to situations where the performance of a portfolio is persistently below that of its reference market. The disposition effect is often explained as a manifestation of loss aversion. Other sub-optimal behaviours can also be identified, such as home bias, the consequence of which is poor portfolio diversification due to concentration on domestic securities.

Secondly, all stakeholders (financial industry, intermediaries, political leaders) will need to get involved in developing financial education. Assuming that the majority of retail investors subscribe to unit-linked products, which are often more profitable than euro-denominated assets, they will soon be faced with questions relating to basic financial market concepts, such as:

- What's the difference between a stock and a bond?

- What is the advantage of a diversified portfolio?

- How do you measure the profitability and risk of a financial instrument?

- What is compound interest?

- What impact does inflation have on profitability?

"Les Français nuls en finance!", interview with Christophe Nijdam, head of European research at Expert Corporate Governance Service (Xerfi canal, October 2019).

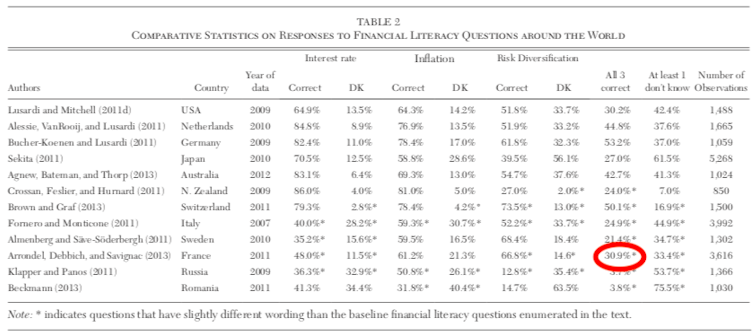

The answer to all these questions is elementary for professionals, but far from obvious for individual customers. Academic studies in financial litteracy show that France is lagging behind other countries in the world. For example, on fundamental questions such as those mentioned above, the country score (percentage of total number of correct answers) is 30.9% in France, compared with 53.2% in Germany and 44.8% in the Netherlands. These figures show the extent of France's deficit in this area, and the task ahead.

, 2014). Gflec.org

Does this mean that euro funds are finished for good? The answer is no. The place of the euro fund should be that traditionally allocated to the risk-free asset in financial theory, i.e., a vehicle for satisfying strong risk aversion. Risk-free assets offer low returns and a capital guarantee, but they are no longer destined to receive 80% of savers' contributions.

The transformation of guaranteed savings into non-guaranteed savings is positive for the financing of the economy, and is a good thing for politicians. On the other hand, they must accept that it is essential to bring savers up to speed, in order to avoid disappointments such as those experienced by these same savers in 2001 during the tech stock bubble.

This article is republished from The Conversation under Creative Commons license. Read the original article.

Picture on freepik

![[#dataviz] Entrepreneurs : la "dette ESG", ça vous parle ?](/sites/default/files/styles/actu_850_480/public/2024-09/2024-09-header-dataviz-resp-entrepren-edhec-b.jpg?itok=I4Ke8WR3)